[fusion_builder_container hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” overlay_color=”” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” padding_top=”” padding_bottom=”” padding_left=”” padding_right=””][fusion_builder_row][fusion_builder_column type=”1_6″ layout=”1_6″ spacing=”” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” hover_type=”none” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” border_radius=”” box_shadow=”no” dimension_box_shadow=”” box_shadow_blur=”0″ box_shadow_spread=”0″ box_shadow_color=”” box_shadow_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”” margin_bottom=”” background_type=”single” gradient_start_color=”” gradient_end_color=”” gradient_start_position=”0″ gradient_end_position=”100″ gradient_type=”linear” radial_direction=”center” linear_angle=”180″ background_color=”” background_image=”” background_image_id=”” background_position=”left top” background_repeat=”no-repeat” background_blend_mode=”none” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” filter_type=”regular” filter_hue=”0″ filter_saturation=”100″ filter_brightness=”100″ filter_contrast=”100″ filter_invert=”0″ filter_sepia=”0″ filter_opacity=”100″ filter_blur=”0″ filter_hue_hover=”0″ filter_saturation_hover=”100″ filter_brightness_hover=”100″ filter_contrast_hover=”100″ filter_invert_hover=”0″ filter_sepia_hover=”0″ filter_opacity_hover=”100″ filter_blur_hover=”0″ last=”no”][/fusion_builder_column][fusion_builder_column type=”2_3″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” border_position=”all” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” center_content=”no” last=”no” min_height=”” hover_type=”none” link=””][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

U.S. Markets:

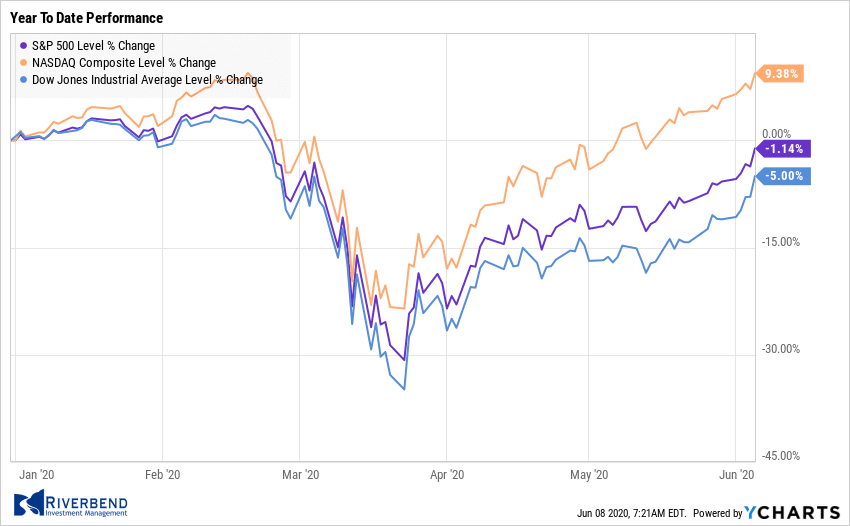

U.S. stocks recorded their best weekly gain in two months as investors celebrated signs of the beginning of an economic recovery.

The Dow Jones Industrial Average added 1,728 points to close at 27,111, a gain of 6.8%. The technology-heavy NASDAQ Composite established an intra-day all-time high before pulling back but still finishing up 3.4%. The large cap S&P 500 rose for a third consecutive week gaining 4.9%.

The smaller-cap indexes were particularly strong with the small cap Russell 2000 and mid cap S&P 400 surging 8.1% and 8.3%, respectively. Value stocks outperformed growth shares by a wide margin.

International Markets:

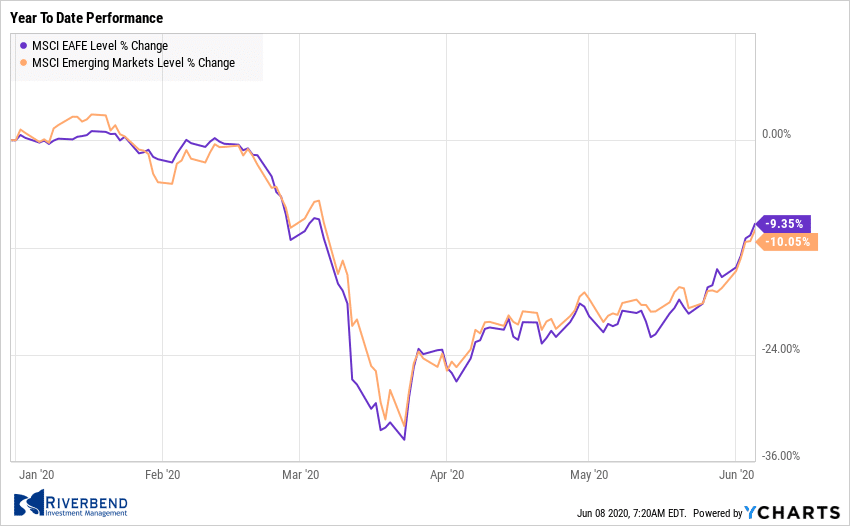

The rally was global, with all major indexes finishing the week in the green. Canada’s TSX rose 4.4%, while the United Kingdom’s FTSE 100 added 6.7%. France’s CAC 40 and Germany’s DAX gained 10.7% and 10.9%, respectively.

The rally was global, with all major indexes finishing the week in the green. Canada’s TSX rose 4.4%, while the United Kingdom’s FTSE 100 added 6.7%. France’s CAC 40 and Germany’s DAX gained 10.7% and 10.9%, respectively.

In Asia, China’s Shanghai Composite finished up 2.8% and Japan’s Nikkei added 4.5%. As grouped by Morgan Stanley Capital International, developed markets finished the week up 7.0%, while emerging markets surged a whopping 8.5%.

Commodities:

Precious metals sold off in the face of strength in the equities markets. Gold retreated -3.9% to $1683 per ounce, while the often more volatile Silver gave up -5.5% to $17.48 per ounce.

Oil rallied for a sixth consecutive week surging 11.4% to $39.55 per barrel of West Texas Intermediate crude.

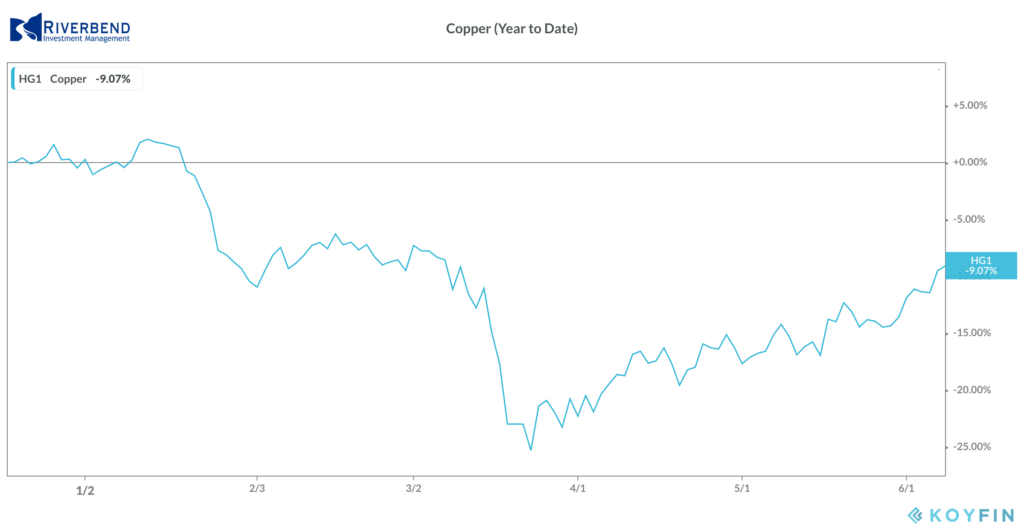

The industrial metal copper, viewed by some analysts as a barometer of global economic health due to its wide variety of industrial uses, rose for a third consecutive week by gaining 5.4%.

U.S. Economic News:

The number of Americans seeking first-time unemployment benefits fell for a ninth consecutive week last week to 1.877 million. Economists had expected a reading of 1.8 million. While readings continued to decline they still remain far above the average 200-300,000 weekly readings from the beginning of the year. This suggests that while the labor market is recovering as state economies gradually reopen, it is still far from the pre-pandemic normal.

Continuing claims, which counts the number of Americans already receiving benefits, increased by 437,000 to 19.3 million based on unadjusted figures from the Bureau of Labor Statistics. That number is reported with a one-week delay.

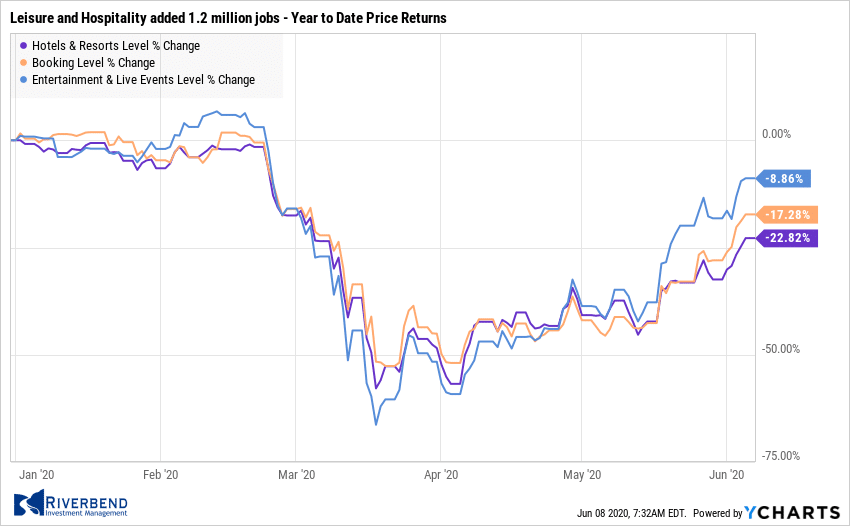

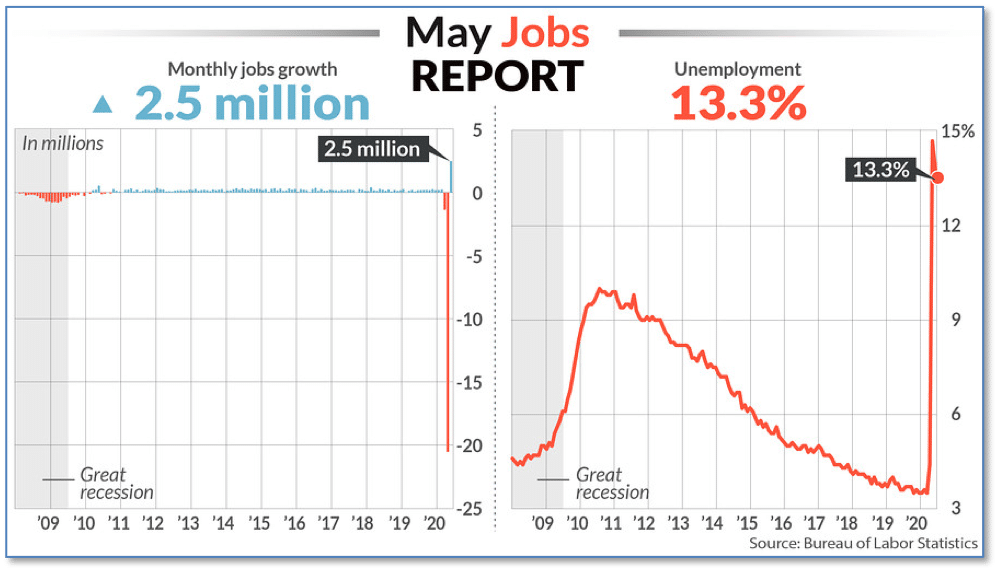

In what is likely the biggest shock of all time in employment reports, nonfarm payrolls actually increased by 2.5 million people in May as the economy started to reopen from the COVID-19 shutdowns.

The Dow Jones consensus was for a further decline of 8.3 million. Furthermore, the unemployment rate fell 1.4 points to 13.3% despite estimates of an unemployment rate of 19.5%. The sectors that were impacted most heavily by the pandemic and social distancing in March and April led the recovery.

Leisure and Hospitality added 1.2 million jobs, the construction sector gained 464,000, and health care and social assistance added 391,000. Nearly all the other major industries posted smaller gains.

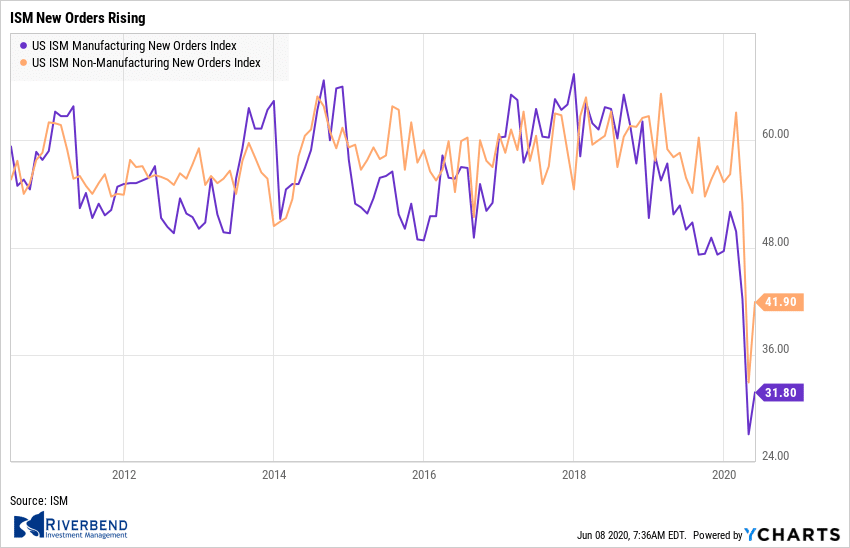

American manufacturers are still struggling from corona-virus related shutdowns and the slowdown in global trade, but they showed faint signs of revival last month, a survey of executives found.

The Institute for Supply Management (ISM) said its manufacturing index climbed to 43.1 in May, rebounding off the 11-year low hit in April. The reading suggests the worst of the economic damage from the pandemic may be behind us. Despite the improvement, economists had expected a slightly higher reading of 44.

In the report, ISM’s indexes for new orders, production and employment all rose, but from historically low levels that showed the economy shrinking at its fastest pace in a decade. Twelve of the 18 industries tracked by ISM contracted in May. Scott Brown, chief economist at Raymond James stated the report was “still very weak, but with some hope for improvement.”

Retailers, restaurants, and other service-related companies began to recover from the coronavirus pandemic in May, a survey showed. The Institute for Supply Management (ISM) reported the services sector, like the manufacturing sector, also rebounded in May with its first increase in three months.

ISM’s Non-Manufacturing Index rose 3.6 points to 45.4. Economists had expected a reading of 44.0. While still in recession territory, the reading indicates a slower pace of contraction in services activity. Three of the four components of the index increased last month.

New orders, business activity, and employment all bounced off record low levels, but remained below the breakeven level of 50. Four of the 18 service industries tracked by ISM expanded in May, up from a record-low of just two in April. The services side of the U.S. economy is huge, employing more than 80% of all American workers.

Chart of the Week:

Among market-moving economic reports the monthly payrolls report is among the most influential—and this week’s report was no disappointment.

Almost all analysts were caught flatfooted at its release, with the consensus forecast expecting a loss of 7.25 million additional jobs and an unemployment rate of 19.0%.

Kate Bahn, director of labor market policy and economist at the Washington Center for Equitable Growth was only able to mutter “WTF” at the release, while David Donabedian, chief investment officer at CIBC Private Wealth Management was quick to adapt to the new data stating that while the economy remains in a deep recession, “it is also clear that the recovery has begun, and that it is ahead of schedule.”

Riverbend Indicators Update:

Counting-up of the number of all our indicators that are ‘Up’ for U.S. Equities the current tally is that three of four are Positive, representing a multitude of timeframes (two that can be solely days/weeks, or months+ at a time; another, a quarter at a time; and lastly, the {typically} years-long reading, that being the Cyclical Bull or Bear status).

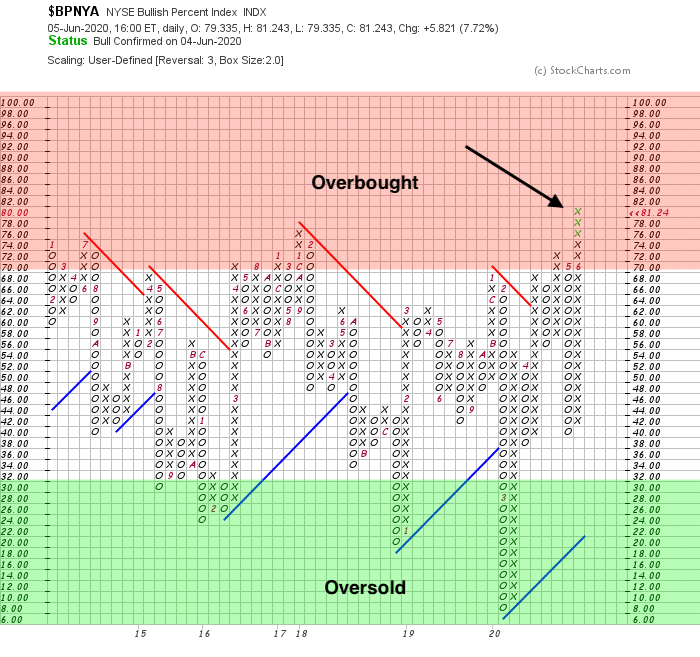

While investors are becoming more enthusiastic about the recovery in stock prices, they may want to proceed with caution in the short term.

While investors are becoming more enthusiastic about the recovery in stock prices, they may want to proceed with caution in the short term.

Markets continue to rise into historically overbought levels as the current NYSE Bullish Percent Index reading is above 80%. (Levels above 70% are considered overbought.)

However, it should be noted that markets can remain in overbought status for long periods of time.

The Week Ahead:

Monday: German Industrial Production m/m -16.0% exp, -9.2% prior

Tuesday: U.S. NFIB Small Business Index 92.1 exp, 90.9 prior U.S. JOLTS Jobs Openings N/A exp, 6.19 mln prior U.S. 10-year Note Auction 0.70% WI, 2.7 b/c China CPI y/y +2.7% exp, +3.3% prior

Wednesday: FOMC U.S. CPI m/m 0.0% exp, -0.8% prior U.S. Core CPI m/m 0.0% exp, -0.4% prior FOMC Monetary Policy Statement / Projections

Thursday: U.S. PPI m/m +0.1% exp, -0.1% prior U.S. Unemployment Claims 1550k exp, 1877k prior

Friday: Sentiment UK GDP m/m -18.0% exp, -5.8% prior Prelim UoM Consumer Sentiment 75.0 exp, 72.3 prior

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container hundred_percent=”no” hundred_percent_height=”no” hundred_percent_height_scroll=”no” hundred_percent_height_center_content=”yes” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” status=”published” publish_date=”” class=”” id=”” border_size=”” border_color=”” border_style=”solid” margin_top=”” margin_bottom=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” gradient_start_color=”” gradient_end_color=”” gradient_start_position=”0″ gradient_end_position=”100″ gradient_type=”linear” radial_direction=”center” linear_angle=”180″ background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ background_blend_mode=”none” video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” filter_hue=”0″ filter_saturation=”100″ filter_brightness=”100″ filter_contrast=”100″ filter_invert=”0″ filter_sepia=”0″ filter_opacity=”100″ filter_blur=”0″ filter_hue_hover=”0″ filter_saturation_hover=”100″ filter_brightness_hover=”100″ filter_contrast_hover=”100″ filter_invert_hover=”0″ filter_sepia_hover=”0″ filter_opacity_hover=”100″ filter_blur_hover=”0″][fusion_builder_row][/fusion_builder_row][/fusion_builder_container]