Market Update

Despite Friday’s decline, major U.S. stock indices had a strong week, with the DJIA enjoying its best week this year, nearing the 40,000-point mark.

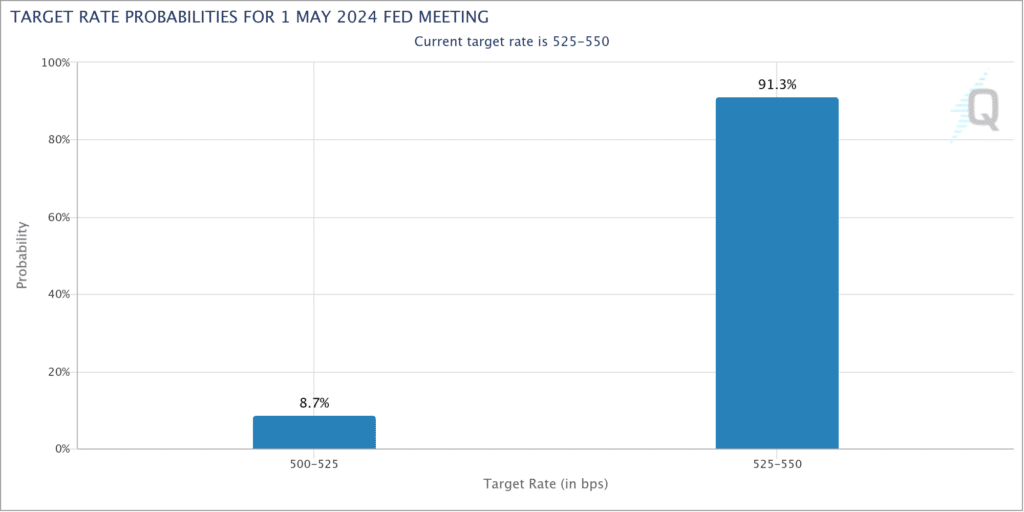

The focus was on the Federal Reserve’s meeting, which concluded with unchanged rates, as anticipated. However, Fed Chair Jerome Powell’s announcement of upcoming rate cuts, despite recent high inflation reports, surprised and reassured investors.

The Fed’s statement highlighted solid economic growth, strong job gains, low unemployment, but acknowledged persistent high inflation. It indicated no rate cuts until inflation is confidently on a path to 2%, while also continuing its plan to reduce its Treasury and mortgage-backed securities holdings.

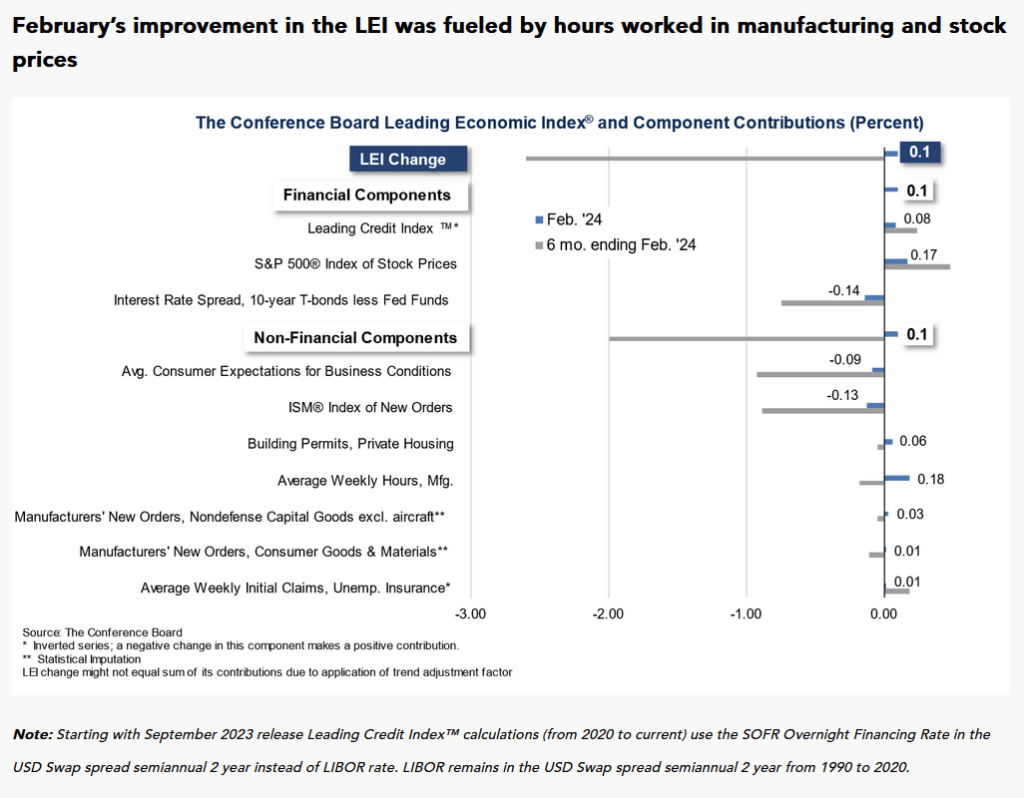

In addition, the Conference Board’s Leading Economic Index (LEI) for the U.S. slightly rose by 0.1 percent to 102.8 in February 2024 after a 0.4 percent drop in January, marking its first increase since February 2022.

The LEI saw a 2.6 percent decrease from August 2023 to February 2024, less than the previous six months’ 3.8 percent fall.

Factors like increased manufacturing hours, stock prices, the Leading Credit Index, and residential construction contributed to this rise.

However, consumer expectations and new orders remain low, with the LEI’s six- and twelve-month growth rates still negative, indicating ongoing economic challenges. The Conference Board forecasts a slowdown in annualized U.S. GDP growth from Q2 to Q3 2024 due to higher consumer debt and interest rates impacting spending.

Technical Update

What’s Going On In Your Portfolio?

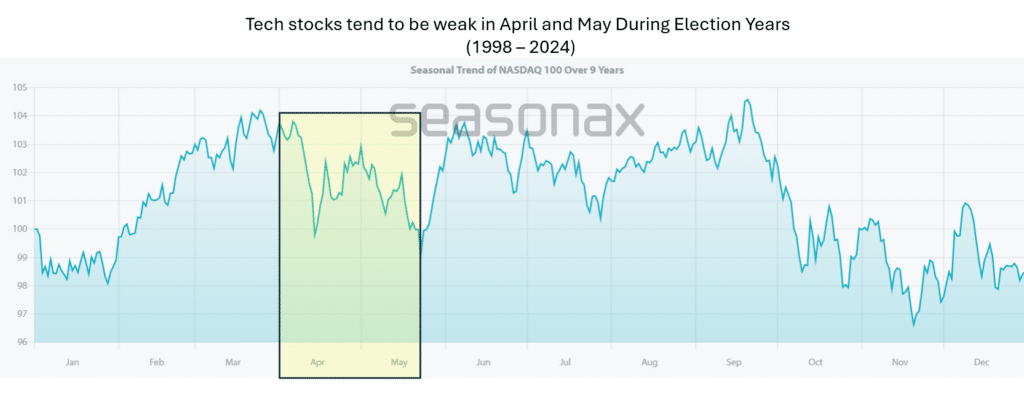

Historically, the market is entering a period of time where technology stocks tend to be weak and this year seems to be no different.

As the markets continue to rotate away from technology, I have been reallocating portfolios so that they lean more toward value.

This includes sectors like Financials, Energy, and Industrials.

Portfolios still are partially allocated to cash (money market) as well. I am keeping a close eye for more opportunities during the period. Currently, money markets are yielding slightly above 5%.

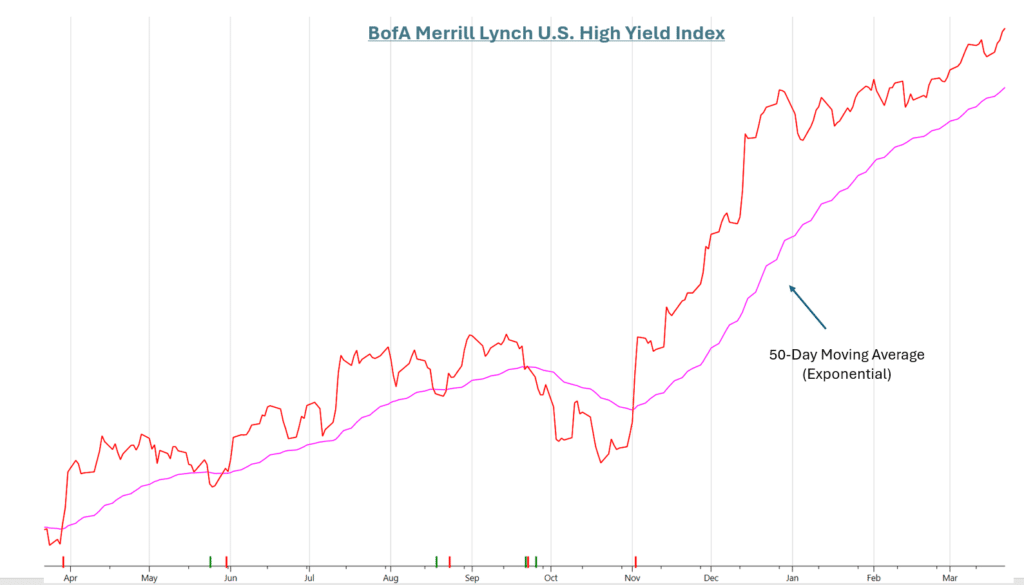

In our more conservative accounts, High Yield Bonds continue to be in favor as the BofA ML High Yield Index still remains in a positive trend. In addition to a rising trend, the high-yield bonds in our client accounts are yielding slightly above 8%.

Looking Ahead

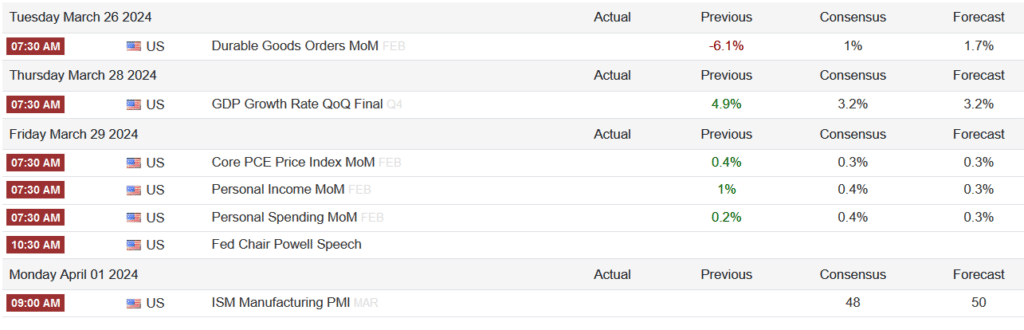

Source: TradingEconomics