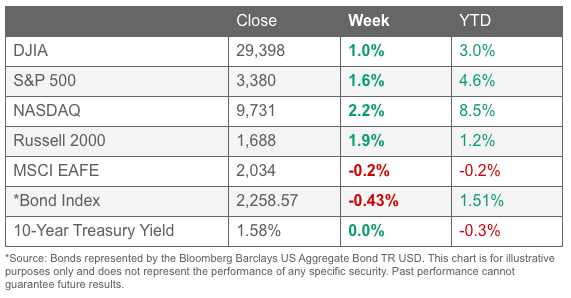

Stocks recorded a second week of solid gains as investors grew more confident that the new coronavirus (officially dubbed “COVID-19”) would be contained. The gains carried the large-cap indexes and the NASDAQ Composite to new record highs, with the latter receiving an extra boost from the continued strong performance of technology stocks.

The Dow Jones Industrial Average added 295 points, or 1.0%, finishing the week at 29,398, its second week of gains. The technology-heavy NASDAQ followed last week’s surge with an additional 2.2% gain to 9,731. By market cap, the large cap S&P 500 added 1.6%, while the mid cap S&P 400 and small cap Russell 2000 indexes gained 2.3% and 1.9%, respectively.

*as of 2/14/20

International Markets: Canada’s TSX gained 1.1%, while across the Atlantic the United Kingdom’s FTSE 100 finished the week down -0.8%. On Europe’s mainland France’s CAC 40 rose 0.7%, Germany’s DAX gained 1.7%, and Italy’s Milan FTSE finished up 1.6%. China’s Shanghai Composite rebounded 1.4% while Japan’s Nikkei retreated -0.6%.

As grouped by Morgan Stanley Capital International, developed markets finished the week up 0.4%, while emerging markets added 1.9%.

Commodities: Precious metals retraced some of last week’s decline. Gold added 0.8%, or $13, to finish the week at $1586.40 per ounce, while Silver rebounded 0.2% to $17.73 per ounce.

Oil had its first up week in five, closing up 3.4% to $52.05 per barrel of West Texas Intermediate. The industrial metal copper, viewed by some analysts as a barometer of world economic health due to its wide variety of uses, rose for a second week gaining 1.8%.

Oil had its first up week in five, closing up 3.4% to $52.05 per barrel of West Texas Intermediate. The industrial metal copper, viewed by some analysts as a barometer of world economic health due to its wide variety of uses, rose for a second week gaining 1.8%.

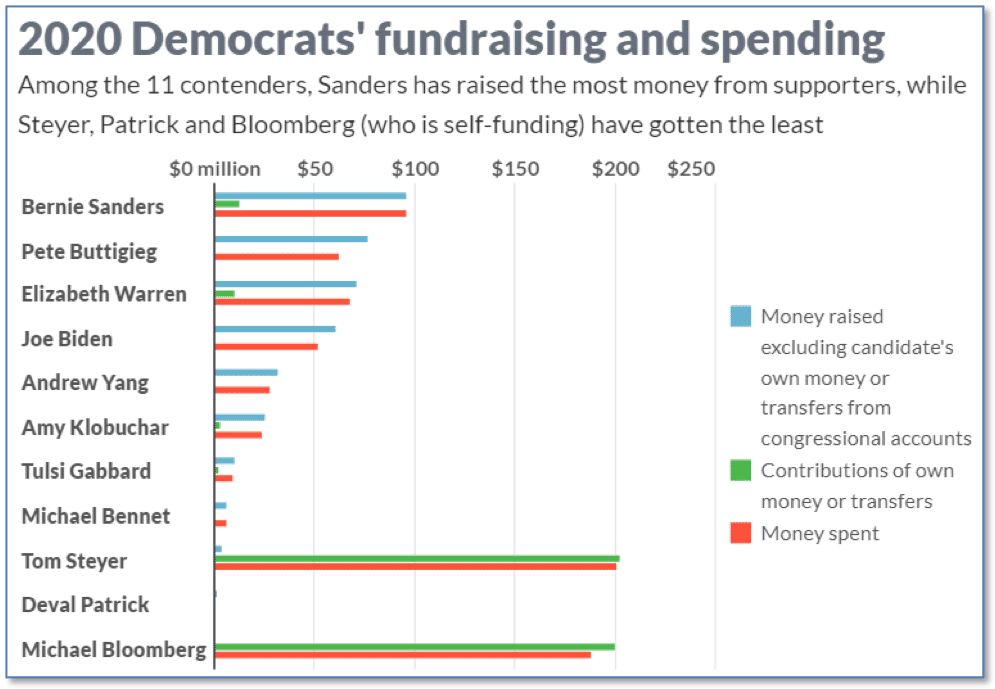

Chart of the Week

When billionaires Michael Bloomberg and Tom Steyer threw their names in the hat for the Democratic nomination for president of the United States, most probably expected they would spend some of their own money in the pursuit of the nomination. But few expected how they would bury the race in their own money.

To date, Steyer and Bloomberg have each spent nearly $200 million, each more than double Democratic contender Bernie Sanders, and each more than three times Elizabeth Warren and Joe Biden. All that money doesn’t seem to have done much for Tom Steyer, but Bloomberg’s omnipresent advertising in critical markets has propelled him higher in the polls steadily. (Chart from Marketwatch.com)

Economic Update

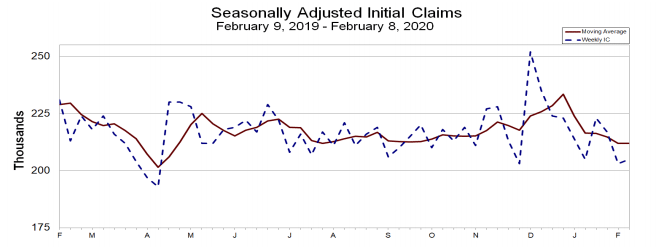

source: Department of Labor

The number of Americans seeking first-time unemployment benefits rose slightly in early February, but remained near their lowest levels in 50 years as the economy continues into its record tenth year of expansion. The Labor Department reported initial claims ticked up 2,000 to 205,000. The reading was below economists’ forecast of 211,000. The less volatile monthly average of new claims remained unchanged at 212,000.

Meanwhile, continuing claims, which counts the number of people already receiving benefits, fell by 61,000 to 1.69 million. Lewis Alexander, chief U.S. economist at Nomura stated, “Initial unemployment claims have returned to low levels following holiday-related volatility, consistent with our view that the labor market remains strong.”

The Labor Department’s Job Openings and Labor Turnover Survey (JOLTS) reported that the number of job openings in the United States fell to a 2-year low in December. The number of job openings retreated by over 300,000 to 6.42 million at the end of 2019—the second significant decline in a row. Job openings had hit their highest level on record at 7.63 million just a year ago.

In the details of the report, job openings declined the most in transportation, warehousing, real estate, and education. Furthermore, the “quits rate”, believed to be closely-watched by the Federal Reserve for the state of the labor market, ticked down to 2.5% in the private sector. Analysts monitor the quits rate for the health of the labor market as it is assumed that one would only quit a job in favor of a more lucrative one.

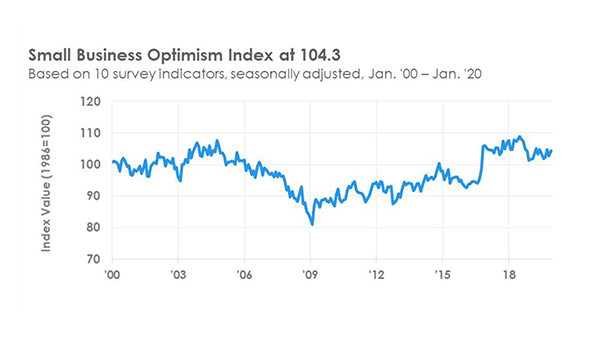

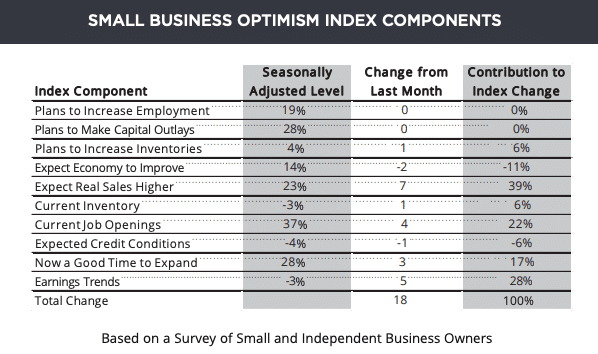

source: NFIB Research Center

Small business owners turned more optimistic about sales and profits at the beginning of the year, but they are still struggling to find qualified workers, according to a closely watched survey. The National Federation of Independent Business (NFIB) reported its index of small business optimism rebounded 1.6 points in January to 104.3. For the most part, business owners weren’t concerned about the impeachment trial of President Donald Trump—the gauge that measures uncertainty remained essentially unchanged.

The biggest worry of small business owners continued to be the shortage of skilled employees available for hire. A quarter of owners stated it’s their number one problem—more than taxes or regulations. Many reported they’ve had to increase wages and benefits to attract talent.

The biggest worry of small business owners continued to be the shortage of skilled employees available for hire. A quarter of owners stated it’s their number one problem—more than taxes or regulations. Many reported they’ve had to increase wages and benefits to attract talent.

Sales at the nation’s retailers rose modestly last month as Americans spent more on eating out and furnishing their homes. Retail sales increased 0.3% in January, matching the consensus forecast. Over the past three months, sales were up a steady 0.2%, but slower than the pace in mid-2019.

Notably, building materials, garden equipment, and supplies rose 2.1%, the most in five months, while furniture and home furnishings rebounded 0.6%. The advance in these housing-related categories suggests stronger housing demand at the start of the year. On a year-over-year trend basis, retail sales were up 4.4% indicating that despite some weakness, consumer goods spending growth is still robust.

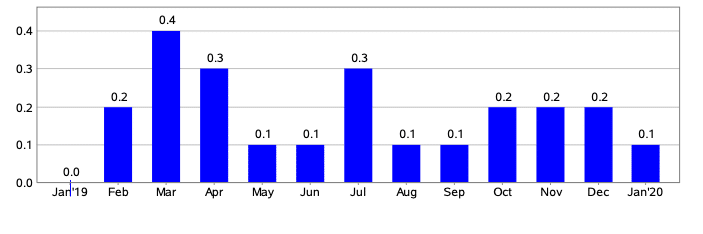

One-month percent change in CPI for All Urban Consumers (CPI-U), seasonally adjusted, Jan. 2019 – Jan. 2020

Percent change. Source: BLS

Inflation rose just slightly last month suggesting that the Federal Reserve will have no reason to hike interest rates anytime soon. The Bureau of Labor Statistics reported the Consumer Price Index (CPI) ticked up 0.1% in January, below the consensus of 0.2%. Food prices rose by 0.2%, while energy declined -0.7%–its first downtick in four months. Core CPI, which excludes food and energy, increased by 0.2%. The cost of shelter, medical care services, apparel, and education all increased last month, while the price of drugs and used vehicles fell.

Year-over-year, the CPI increased 2.5%–the most since October 2018, but still historically low. Overall, the report shows that consumer price inflation remains subdued, supporting a continued easy monetary policy stance from the Fed.

Federal Reserve Chairman Jerome Powell offered testimony to the House Financial Services Committee this week in which he stated that some of the forces that held back U.S. economic growth last year have eased, but risks to the outlook remain, particularly from the coronavirus. “We are closely monitoring the emergence of the coronavirus, which could lead to disruptions in China that spill over to the rest of the global economy,” Powell said. The U.S. central bank cut interest rates by a quarter percent at three successive meetings last fall, bringing its benchmark rate down to a range of 1.5-1.75%.

Powell stated that he believed the current accommodative stance of policy was still appropriate to support growth, but stated, “If developments emerge that cause a material reassessment of our outlook, we would respond accordingly.”

Riverbend Market Indicators

As a reading of our Bull-Bear Indicator for U.S. Equities (comparative measurements over a rolling one-year timeframe), we remain firmly in Cyclical Bull territory.

Counting up the number of all our indicators that are ‘Up’ for U.S. Equities, we are in ‘Mostly Positive’ territory.

This status is drawn from a scale that goes from Negative, to Mostly Negative, to Neutral, to Mostly Positive, to Positive, and totals-up current readings based on a multitude of timeframes (days/weeks/months/quarters/years, the ‘years’ being the Cyclical Bull or Bear reading).

The Week Ahead

Monday: Market Closed

Tuesday: German ZEW Economic Sentiment 20.0 exp, 26.7 prior U.S. Empire State Manufacturing Index 5.1 exp, 4.8 prior U.S. NAHB Housing Market Index 75 exp, 75 prior

Wednesday: UK CPI y/y +1.7% exp, +1.3% prior U.S. Building Permits 1.45mm exp, 1.42mm prior U.S. Housing Starts 1.40mm exp, 1.61mm prior U.S. FOMC Meeting Minutes

Thursday: U.S. Philly Fed Manufacturing Index 10.1 exp, 17.0 prior

Friday: Manufacturing German Flash Manufacturing PMI 44.8 exp, 45.3 prior Eurozone Flash Services PMI 52.4 exp, 52.5 prior U.S. Flash Manufacturing PMI 51.5 exp, 51.9 prior U.S. Flash Services PMI 53.5 exp, 53.3 prior U.S. Existing Home Sales 5.48 mm exp, 5.54mm prior