The Week in Charts

Market Recap

Last week, U.S. equity markets experienced a modest pullback following the previous week’s substantial gains. This retreat was primarily triggered by Federal Reserve Chair Jerome Powell’s comments suggesting that current economic conditions do not warrant a rapid reduction in interest rates.

Economic Data and Fed’s Perspective

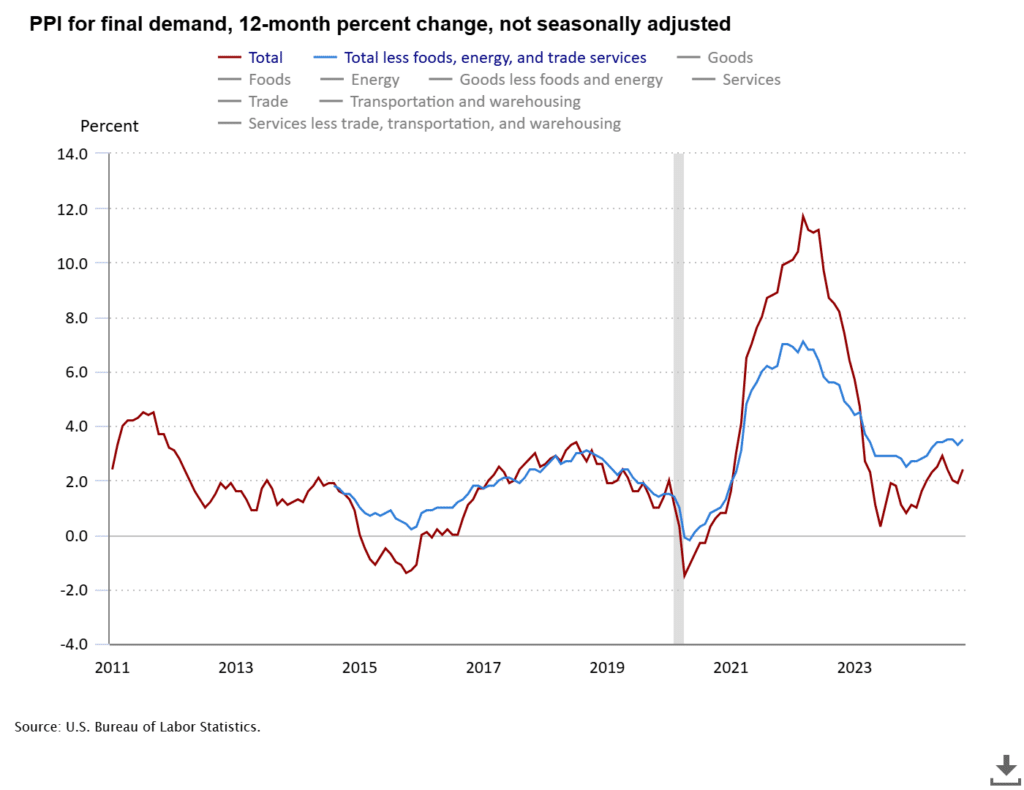

The week’s economic reports, including Wednesday’s Consumer Price Index (CPI) and Thursday’s Producer Price Index (PPI), aligned with Powell’s stance. These indicators showed inflation holding closer to the Fed’s 2% target.

Powell expressed confidence in inflation’s continued movement towards this goal but cautioned that the path might be “sometimes bumpy.”

However, investors were particularly unsettled by Powell’s statement that “the economy is not sending any signals that we need to be in a hurry to lower rates.”

This remark sparked concerns that the Fed might not cut rates as aggressively as previously anticipated. Consequently, Wall Street adjusted its expectations for a December rate cut, dropping the probability from about 80% to approximately 50% following Powell’s comments.

Consumer Price Index Update

The U.S. Bureau of Labor Statistics reported that the Consumer Price Index for All Urban Consumers (CPI-U) increased by 0.2% in October on a seasonally adjusted basis, maintaining the same rate of increase as in the previous three months. Over the last 12 months, the all items index rose by 2.6% before seasonal adjustment.

Key contributors to October’s increase included:

- Shelter index: Up 0.4%, accounting for over half of the monthly all items increase

- Food index: Increased 0.2%

- Energy index: Remained unchanged after a 1.9% decline in September

The index for all items less food and energy rose 0.3% in October, consistent with August and September’s increases.

Retail Sales Show Resilience

October’s retail sales data exceeded economists’ expectations, climbing 0.4% compared to the anticipated 0.3%. Notably, September’s sales figures were revised significantly upward to a 0.8% increase, double the initially reported 0.4% gain.

U.S. retail and food services sales for October 2024 totaled $718.9 billion, marking a 0.4% increase from the previous month and a 2.8% rise from October 2023. The August through October 2024 period saw a 2.3% increase in total sales compared to the same period last year.

Auto sales led October’s gains with a robust 1.6% increase. However, core retail sales (excluding autos and gas) showed more modest growth, edging up just 0.1%.

What’s Going On In Your Portfolio?

We have been taking profits in some technology names and looking for opportunities in non-tech sectors as the market pulls back.

Volatility stops remain in place in case any unforeseen events occur.

Bond portfolios remain fully invested in High-Yield bonds. The BofA Merrill Lynch High Yield Index continues to rise – which has historically been a good sign for the stock market.

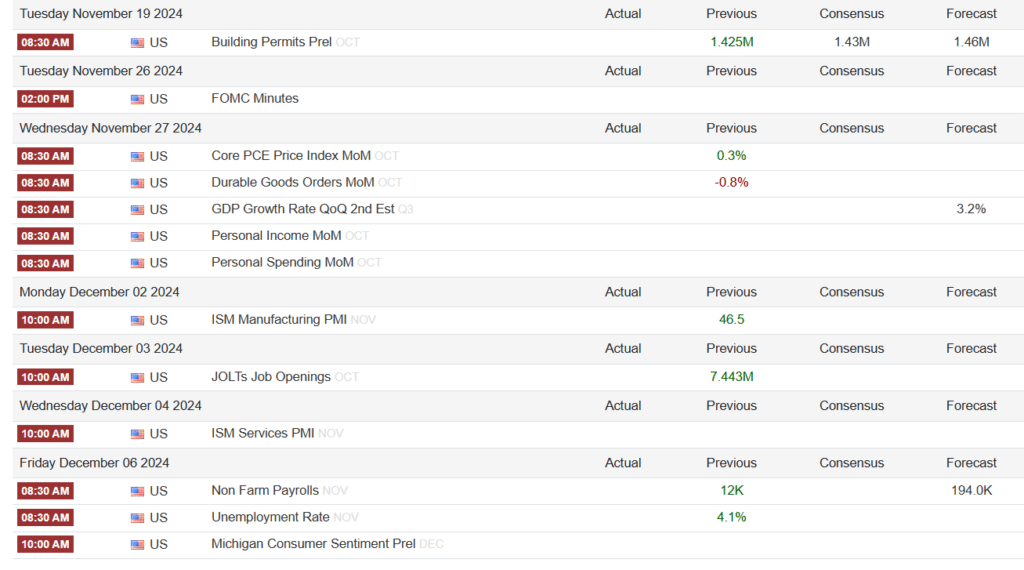

Upcoming Economic Data to Keep an Eye On

Source: Trading Economics