[fusion_builder_container hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” overlay_color=”” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” padding_top=”” padding_bottom=”” padding_left=”” padding_right=””][fusion_builder_row][fusion_builder_column type=”1_6″ spacing=”” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” hover_type=”none” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” border_radius=”” box_shadow=”no” dimension_box_shadow=”” box_shadow_blur=”0″ box_shadow_spread=”0″ box_shadow_color=”” box_shadow_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”” margin_bottom=”” background_type=”single” gradient_start_color=”” gradient_end_color=”” gradient_start_position=”0″ gradient_end_position=”100″ gradient_type=”linear” radial_direction=”center” linear_angle=”180″ background_color=”” background_image=”” background_image_id=”” background_position=”left top” background_repeat=”no-repeat” background_blend_mode=”none” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” filter_type=”regular” filter_hue=”0″ filter_saturation=”100″ filter_brightness=”100″ filter_contrast=”100″ filter_invert=”0″ filter_sepia=”0″ filter_opacity=”100″ filter_blur=”0″ filter_hue_hover=”0″ filter_saturation_hover=”100″ filter_brightness_hover=”100″ filter_contrast_hover=”100″ filter_invert_hover=”0″ filter_sepia_hover=”0″ filter_opacity_hover=”100″ filter_blur_hover=”0″ last=”no”][/fusion_builder_column][fusion_builder_column type=”2_3″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” border_position=”all” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” center_content=”no” last=”no” min_height=”” hover_type=”none” link=””][fusion_text]

[/fusion_text][fusion_vimeo id=”530135417″ alignment=”center” width=”1000″ height=”” autoplay=”false” api_params=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” css_id=”” /][fusion_text]

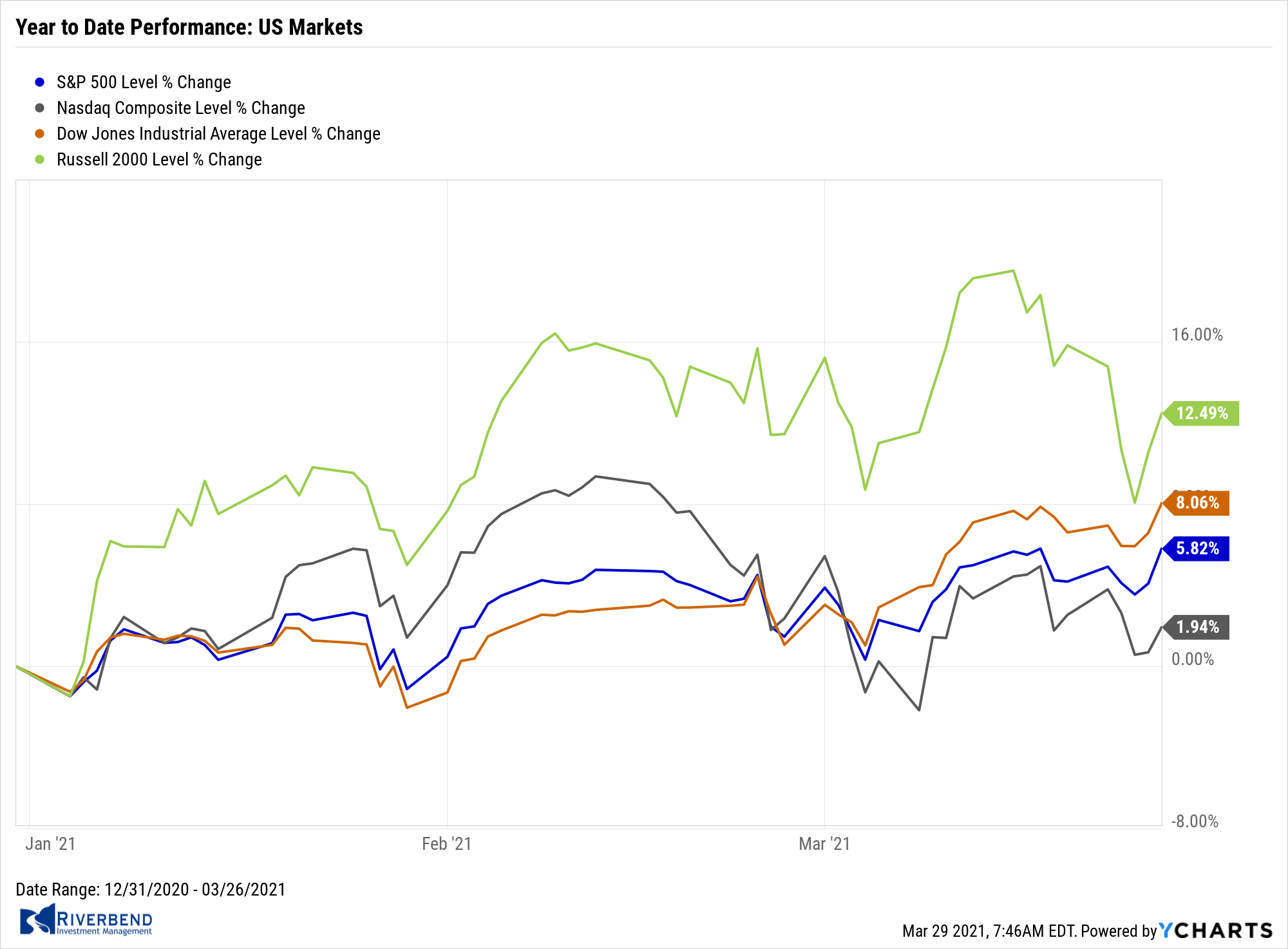

U.S. Markets:

Small-cap stocks lagged for a second consecutive week, signaling a potential pause in their recent market leadership. The Dow Jones Industrial Average added 445 points finishing the week at 33,072, a gain of 1.4%. The technology-heavy NASDAQ Composite shed -0.6% to 13,138.

By market cap, the large cap S&P 500 and mid cap S&P 400 added 1.6% and 0.5%, respectively, while the small cap Russell 2000 ended down -2.9%.

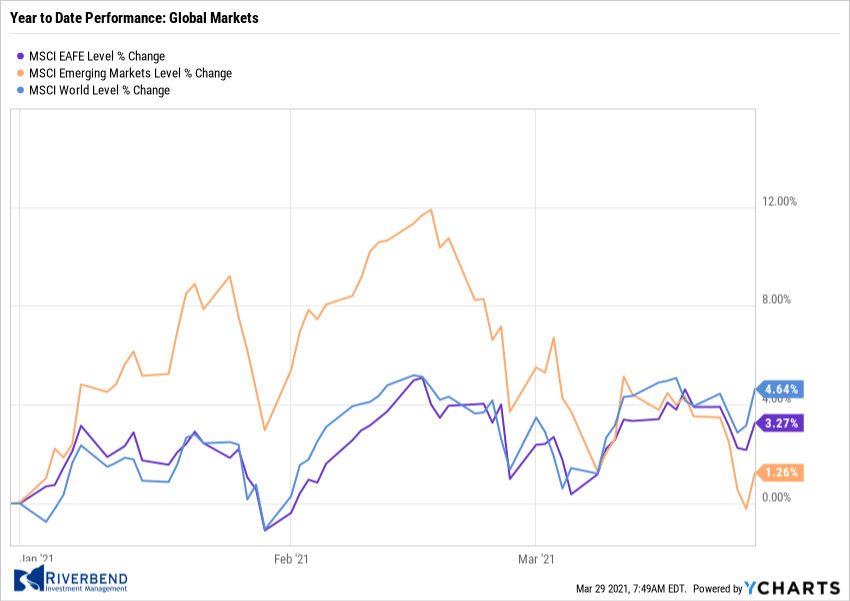

International Markets:

International markets finished the week mixed as well. Canada’s TSX gave up -0.5%, while the United Kingdom’s FTSE added 0.5%. On Europe’s mainland, France’s CAC 40 ticked down -0.2%, while Germany’s DAX rose 0.9%.

In Asia, China’s Shanghai Composite rebounded 0.4% following four weeks of consecutive declines. Japan’s Nikkei closed down -2.1%.

As grouped by Morgan Stanley Capital International, developed markets rose 0.2%, while emerging markets ended the week down -1.5%.

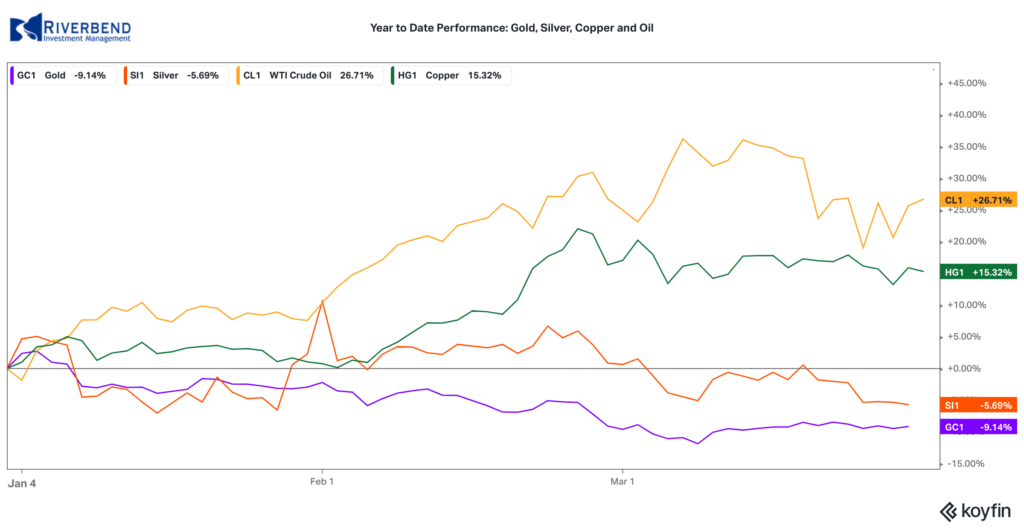

Commodities:

Precious metals saw their first down week in three, with Gold falling -0.5% to $1732.30 an ounce, while Silver declined -4.6% to $25.11.

Crude oil declined for a third consecutive week giving up -0.8% to $60.97 per barrel of West Texas Intermediate crude oil.

The industrial metal copper, viewed by some analysts as a barometer of world economic health due to its wide variety of uses, ended the week down -1.1%.

U.S. Economic News:

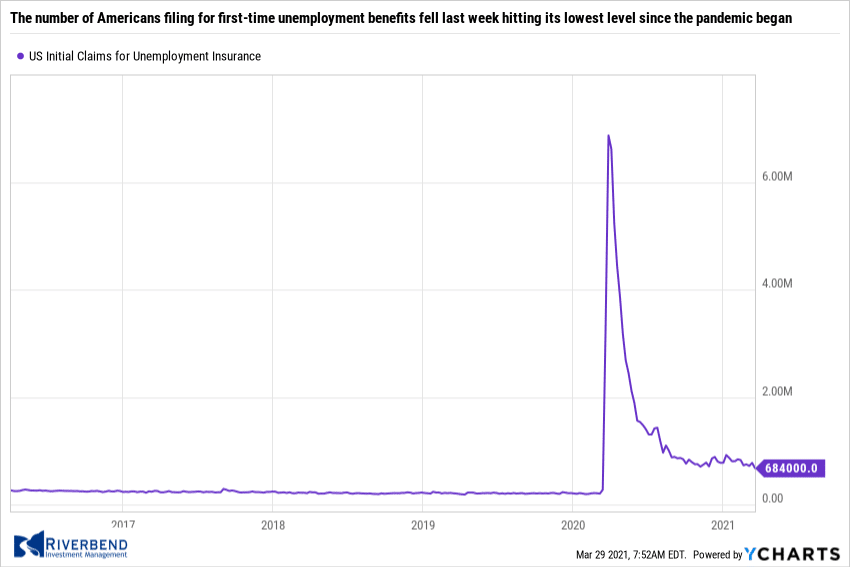

The number of Americans filing for first-time unemployment benefits fell last week hitting its lowest level since the pandemic began. The Labor Department reported initial jobless claims fell by 97,000 to 684,000 in the week ended March 20. Economists had forecast new claims would fall to 735,000. New claims fell the most in Illinois, Ohio, and California. Massachusetts. The only states with notable increases were Virginia and Nevada. Meanwhile, the number of people already collecting benefits fell by 264,000 to 3.87 million. That’s the lowest level since last spring.

The number of Americans filing for first-time unemployment benefits fell last week hitting its lowest level since the pandemic began. The Labor Department reported initial jobless claims fell by 97,000 to 684,000 in the week ended March 20. Economists had forecast new claims would fall to 735,000. New claims fell the most in Illinois, Ohio, and California. Massachusetts. The only states with notable increases were Virginia and Nevada. Meanwhile, the number of people already collecting benefits fell by 264,000 to 3.87 million. That’s the lowest level since last spring.

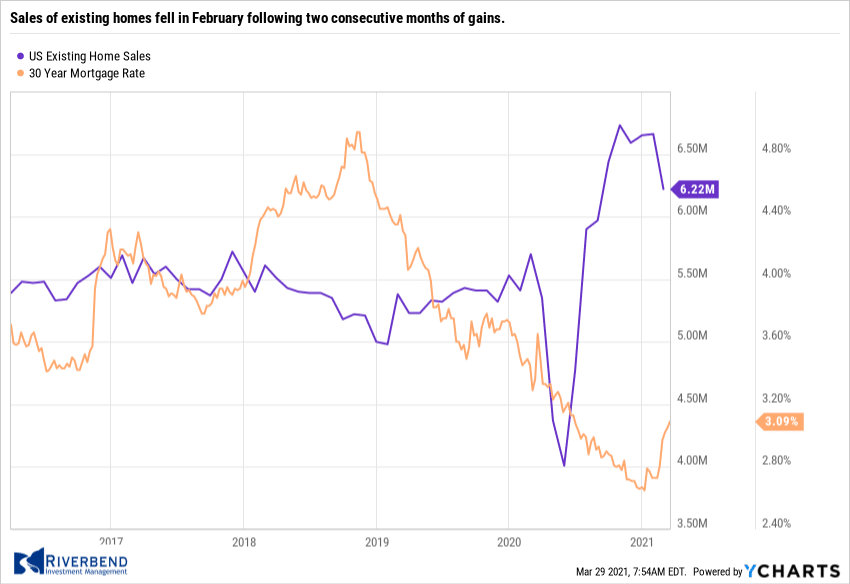

Sales of existing homes fell in February following two consecutive months of gains. The National Association of Realtors (NAR) reported existing-home sales dropped 6.6% from January to a seasonally-adjusted annual rate of 6.22 million. Still, home sales were up 9.1% from the same time last year. Lawrence Yun, chief economist at the National Association of Realtors, noted “Despite the drop in home sales for February — which I would attribute to historically-low inventory — the market is still outperforming pre-pandemic levels.” By region, home sales decreased the most in the Midwest (-14.4%), followed by the Northeast (-11.5%). Sales increased in the West by 4.6%. The median existing-home price in February was $313,000—nearly 16% higher than the same time last year.

Sales of existing homes fell in February following two consecutive months of gains. The National Association of Realtors (NAR) reported existing-home sales dropped 6.6% from January to a seasonally-adjusted annual rate of 6.22 million. Still, home sales were up 9.1% from the same time last year. Lawrence Yun, chief economist at the National Association of Realtors, noted “Despite the drop in home sales for February — which I would attribute to historically-low inventory — the market is still outperforming pre-pandemic levels.” By region, home sales decreased the most in the Midwest (-14.4%), followed by the Northeast (-11.5%). Sales increased in the West by 4.6%. The median existing-home price in February was $313,000—nearly 16% higher than the same time last year.

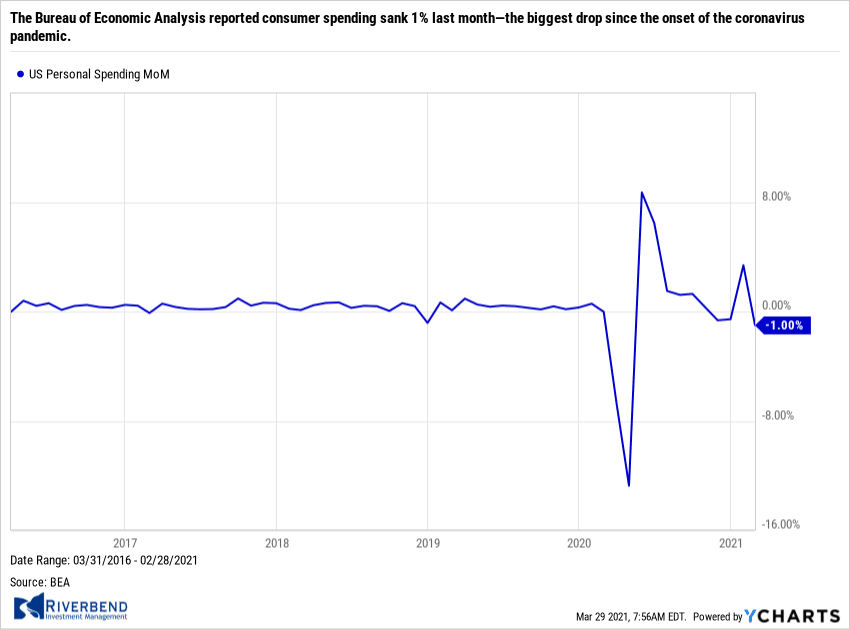

Spending at the consumer level posted its biggest decline in almost a year in February, predominantly due to a bout of harsh winter weather and a delay in government stimulus payments. The Bureau of Economic Analysis reported consumer spending sank 1% last month—the biggest drop since the onset of the coronavirus pandemic. The reading matched economists’ forecasts. Americans reduced spending on an array of goods and services in February, particularly drugs, recreational items and takeout food, more than offsetting increases in outlays on housing, health care, utilities and gasoline.

Spending at the consumer level posted its biggest decline in almost a year in February, predominantly due to a bout of harsh winter weather and a delay in government stimulus payments. The Bureau of Economic Analysis reported consumer spending sank 1% last month—the biggest drop since the onset of the coronavirus pandemic. The reading matched economists’ forecasts. Americans reduced spending on an array of goods and services in February, particularly drugs, recreational items and takeout food, more than offsetting increases in outlays on housing, health care, utilities and gasoline.

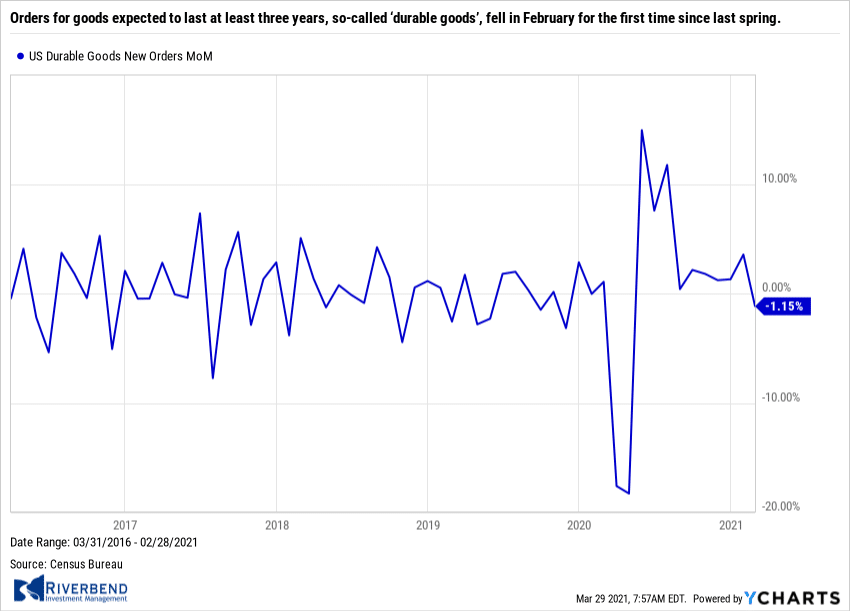

Orders for goods expected to last at least three years, so-called ‘durable goods’, fell in February for the first time since last spring. The Census Bureau reported orders for durable goods fell 1.1%, far below economists’ estimates for a 0.6% increase. The decline in orders last month was broad based. Orders in every major category fell except for commercial passenger planes. Auto makers reported the biggest drop in orders—down -8.7%. If transportation is excluded, durable-goods orders slipped a smaller 0.9% in February. One major concern is the shortages of many key materials used in the production of goods ranging from lumber to computer chips. Stephen Stanley, chief economist at Amherst Pierpont Securities stated, “The primary driver of the drop was the disruptions in the auto industry, as chip shortages have sharply curtailed production.”

Orders for goods expected to last at least three years, so-called ‘durable goods’, fell in February for the first time since last spring. The Census Bureau reported orders for durable goods fell 1.1%, far below economists’ estimates for a 0.6% increase. The decline in orders last month was broad based. Orders in every major category fell except for commercial passenger planes. Auto makers reported the biggest drop in orders—down -8.7%. If transportation is excluded, durable-goods orders slipped a smaller 0.9% in February. One major concern is the shortages of many key materials used in the production of goods ranging from lumber to computer chips. Stephen Stanley, chief economist at Amherst Pierpont Securities stated, “The primary driver of the drop was the disruptions in the auto industry, as chip shortages have sharply curtailed production.”

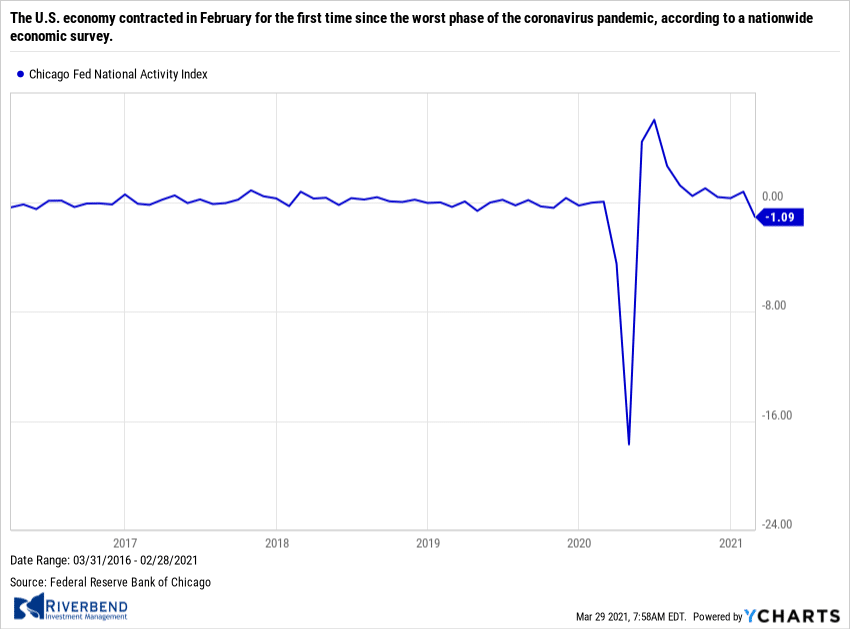

The U.S. economy contracted in February for the first time since the worst phase of the coronavirus pandemic, according to a nationwide economic survey. The Chicago Federal Reserve reported its National Activity Index fell to -1.09 from a revised 0.75 in January. The Chicago Fed index is a weighted average of 85 economic indicators. In the details, only 34 of the 85 indicators made positive contributions. Production-related indicators dragged the index down the most, subtracting -0.85 from the index, down from a positive 0.37 in January. The personal consumption and housing categories also contributed -0.29, down from positive 0.27 in January.

The U.S. economy contracted in February for the first time since the worst phase of the coronavirus pandemic, according to a nationwide economic survey. The Chicago Federal Reserve reported its National Activity Index fell to -1.09 from a revised 0.75 in January. The Chicago Fed index is a weighted average of 85 economic indicators. In the details, only 34 of the 85 indicators made positive contributions. Production-related indicators dragged the index down the most, subtracting -0.85 from the index, down from a positive 0.37 in January. The personal consumption and housing categories also contributed -0.29, down from positive 0.27 in January.

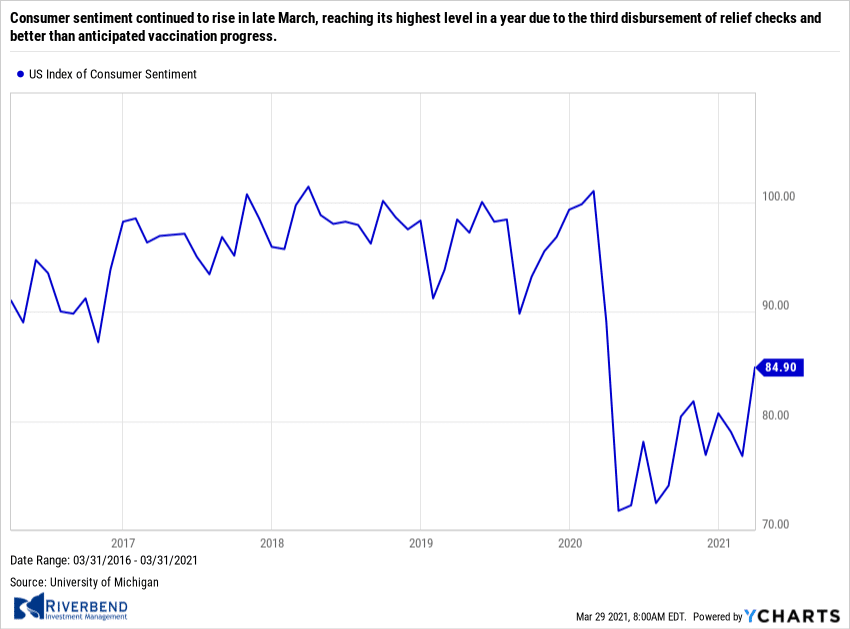

Sentiment among the nation’s consumers is the most upbeat since the onset of the pandemic, a recent survey showed. The University of Michigan reported its consumer sentiment index of March rose 1.9 points to 84.9 in March. Richard Curtin, chief economist of the survey stated, “Consumer sentiment continued to rise in late March, reaching its highest level in a year due to the third disbursement of relief checks and better than anticipated vaccination progress.” However, the index remains about 16 points below its pre-pandemic peak. Still, the attitude of Americans right now about their own personal finances and the broader economy is at a one-year high. Associate economist Mahir Rasheed of Oxford Economics wrote in a note to clients, “We expect attitudes will continue to rebound as the pandemic wanes and economic activity normalizes over the coming months.”

Sentiment among the nation’s consumers is the most upbeat since the onset of the pandemic, a recent survey showed. The University of Michigan reported its consumer sentiment index of March rose 1.9 points to 84.9 in March. Richard Curtin, chief economist of the survey stated, “Consumer sentiment continued to rise in late March, reaching its highest level in a year due to the third disbursement of relief checks and better than anticipated vaccination progress.” However, the index remains about 16 points below its pre-pandemic peak. Still, the attitude of Americans right now about their own personal finances and the broader economy is at a one-year high. Associate economist Mahir Rasheed of Oxford Economics wrote in a note to clients, “We expect attitudes will continue to rebound as the pandemic wanes and economic activity normalizes over the coming months.”

Chart of the Week:

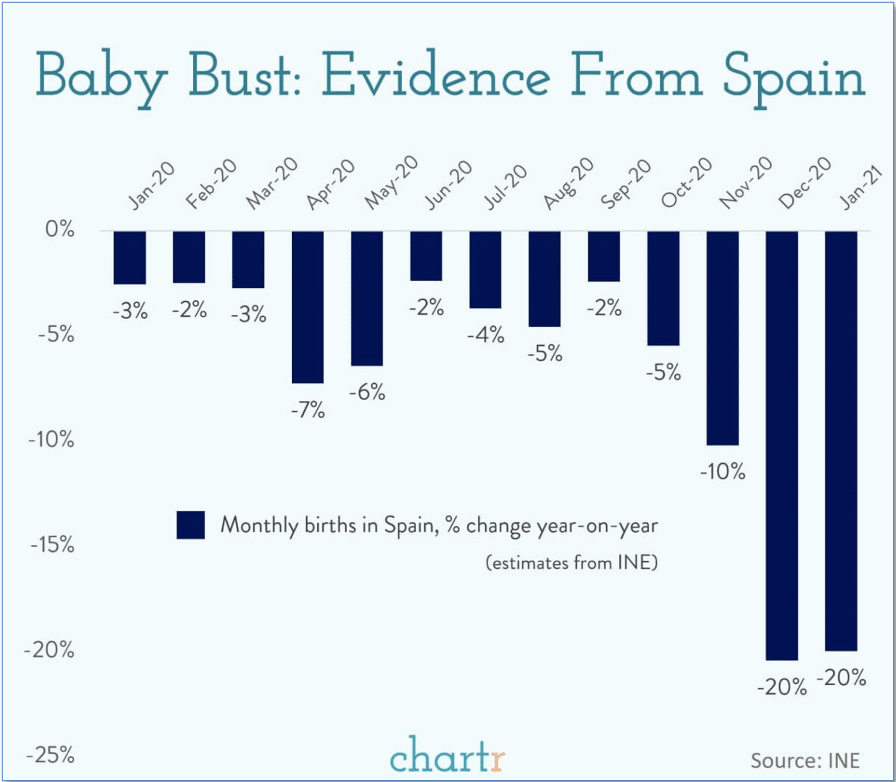

With everyone locked up in their homes around this time last year, many scientists who study population demographics predicted a subsequent “baby boom”. This, however, does not seem to have been the case.

The latest data from Europe suggests advanced economies are almost certainly in for the opposite—a baby bust. Data from Spain estimates the number of babies born between December 2020 and January 2021 was down roughly 20% from the same time the year before.

Data from Italy shows a similar pattern. Italy and Spain already have some of the lowest fertility rates in the world – well below the so-called “replacement rate” – and it is not hard to imagine why potential parents may have put off the enormous responsibility of having children over the past year. (Chart from Chartr.co)

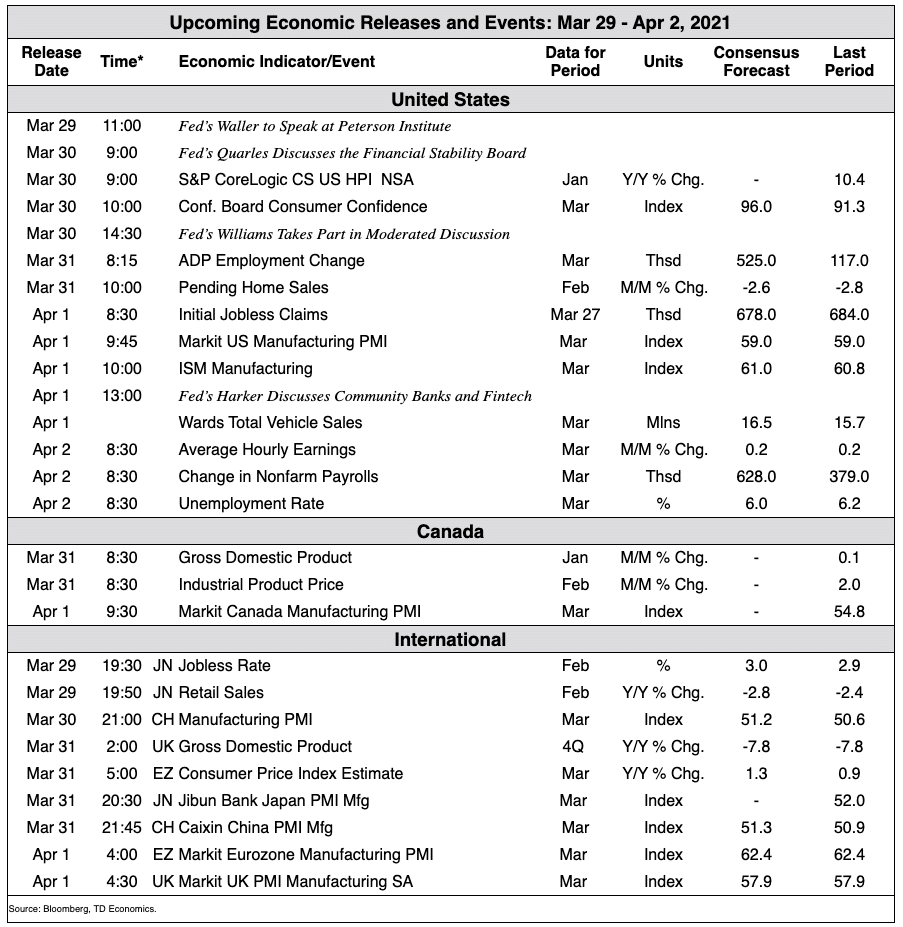

The Week Ahead:

(Sources: All index- and returns-data from Yahoo Finance; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.)

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_6″ spacing=”” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” hover_type=”none” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” box_shadow=”no” box_shadow_blur=”0″ box_shadow_spread=”0″ box_shadow_color=”” box_shadow_style=”” background_type=”single” gradient_start_position=”0″ gradient_end_position=”100″ gradient_type=”linear” radial_direction=”center” linear_angle=”180″ background_color=”” background_image=”” background_image_id=”” background_position=”left top” background_repeat=”no-repeat” background_blend_mode=”none” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” filter_type=”regular” filter_hue=”0″ filter_saturation=”100″ filter_brightness=”100″ filter_contrast=”100″ filter_invert=”0″ filter_sepia=”0″ filter_opacity=”100″ filter_blur=”0″ filter_hue_hover=”0″ filter_saturation_hover=”100″ filter_brightness_hover=”100″ filter_contrast_hover=”100″ filter_invert_hover=”0″ filter_sepia_hover=”0″ filter_opacity_hover=”100″ filter_blur_hover=”0″ last=”no”][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container hundred_percent=”no” hundred_percent_height=”no” hundred_percent_height_scroll=”no” hundred_percent_height_center_content=”yes” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” status=”published” publish_date=”” class=”” id=”” border_size=”” border_color=”” border_style=”solid” margin_top=”” margin_bottom=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” gradient_start_color=”” gradient_end_color=”” gradient_start_position=”0″ gradient_end_position=”100″ gradient_type=”linear” radial_direction=”center” linear_angle=”180″ background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ background_blend_mode=”none” video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” filter_hue=”0″ filter_saturation=”100″ filter_brightness=”100″ filter_contrast=”100″ filter_invert=”0″ filter_sepia=”0″ filter_opacity=”100″ filter_blur=”0″ filter_hue_hover=”0″ filter_saturation_hover=”100″ filter_brightness_hover=”100″ filter_contrast_hover=”100″ filter_invert_hover=”0″ filter_sepia_hover=”0″ filter_opacity_hover=”100″ filter_blur_hover=”0″][fusion_builder_row][/fusion_builder_row][/fusion_builder_container]